The newly enacted Paycheck Protection Program included in the most recent COVID-19 relief package authorizes $349 billion in forgivable loans to small businesses to cover payroll, rent/mortgage and utilities.

Small businesses and sole proprietorships can apply starting on April, 3, 2020. The application form can be found here.

For more details about the program, access the accompanying fact sheet from the Treasury Department.

More Information

Related Posts

Update on the 2024 Election

Given the Republican sweep of the White House, Senate, and House (anticipated vote confirmation in days ahead) in the 2024 election, the outlook is dim…

Bipartisan Medicare Bill Promises Relief for Audiology Providers

Audiologists and other health-care providers have faced growing financial challenges due to Medicare payments that haven’t kept pace with inflation. In late October, the bipartisan…

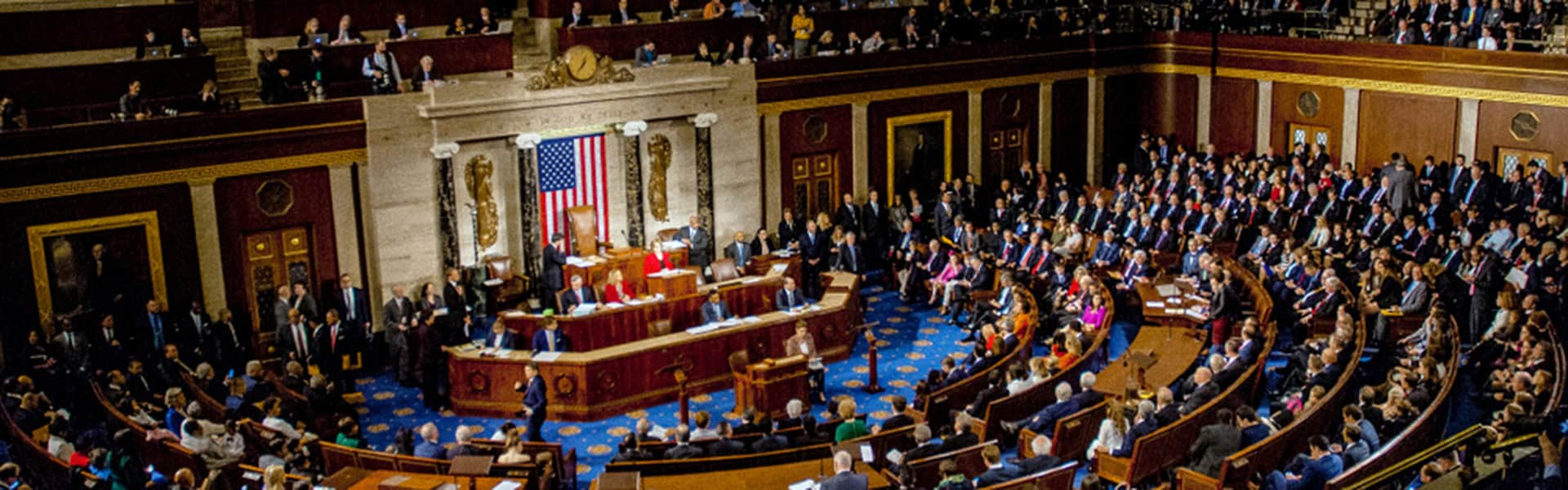

MAAIA Supporters Push for Congressional Action

The Academy, the Academy of Doctors of Audiology (ADA) and the American Speech-Language-Hearing Association (ASHA) facilitated a sign-on letter that went to House and Senate…